The surrogacy journey is emotionally enriching but also a significant financial investment. Moreover, when we talk about the surrogacy cost, you may have to pay somewhere between $50000 to $150000 depending upon the country and region. This is why for intended parents, financially preparing for even affordable surrogacy programs is essential.

That said, we hereby suggest the top ten ways for the intended parents to financially prepare themselves for the surrogacy journey.

Top 10 ways to financially prepare yourself for the surrogacy journey

Create a Budget

The first step is to make a detailed budget for the entire process, which includes surrogate compensation, agency fees, legal fees, medical costs, insurance, and possible miscellaneous expenses like travel. Moreover, knowing the approximate costs will help plan accordingly.

Besides, even if you are opting for a low-cost surrogacy program, you may have to prepare this kind of budget plan in advance. That way, you can streamline your finances in the best manner possible.

Do more savings

Surrogacy comes at a cost. So, intended parents must save aggressively to prepare for their surrogacy journey. Moreover, they must try to cut back on non-essential expenses to accumulate funds for surrogacy. Also, you might want to consider automatic transfers to a dedicated savings account to systematically grow your surrogacy fund.

Fertility Insurance

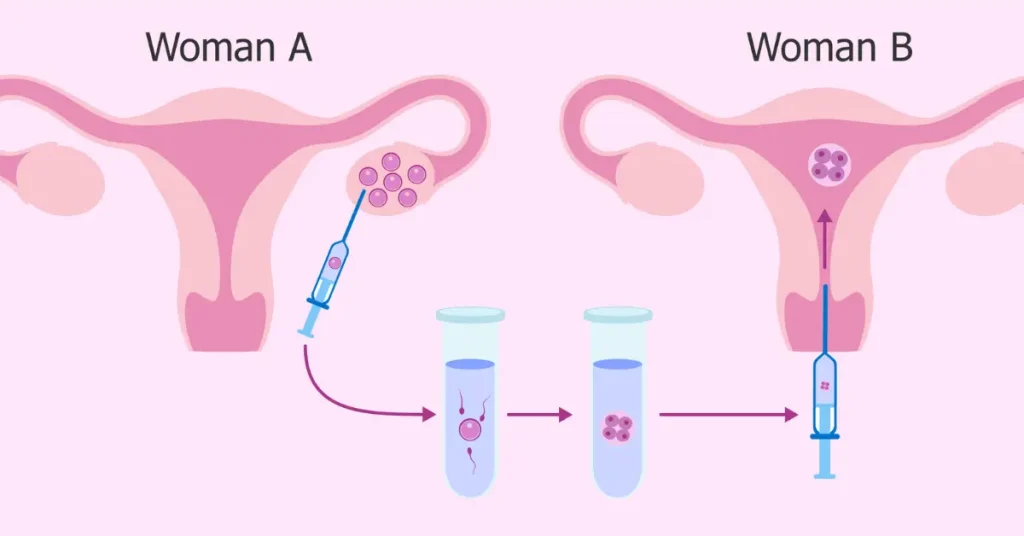

Some insurance policies cover a part of the in-vitro fertilization (IVF) process that surrogacy involves. Hence, look into your current health insurance or consider investing in fertility-specific insurance. While doing that, do consult with some surrogacy professionals about the best insurance options.

Grants and Scholarships

There are organizations providing financial grants or scholarships to individuals and couples seeking assistance with the low-cost surrogacy program. So, you must research and apply for these as early as possible, as they’re often competitive.

Fundraising

Consider crowdfunding or organizing local fundraising events if you are not able to afford the overall expenses. That said, it’s not uncommon for intended parents to ask for financial help from friends, family, and the community, especially with the rise of platforms like GoFundMe.

Financing and Loans

There are loan programs specifically for fertility treatments and surrogacy. Moreover, medical loans can be a viable option, but be sure to read the fine print and understand the interest rates and payment terms.

Surrogacy Agency Payment Plans

You can opt for an affordable surrogacy agency that further offers payment plans, allowing you to spread the cost over a longer period. Still, check with your chosen agency if they provide such a program. Also, do check the proposed terms and conditions before signing up.

Employer Benefits

A handful of employers offer fertility benefits, which may cover a portion of the surrogacy expenses. So, check with your human resources department about any such benefits.

Tax Credits

In certain countries, like the U.S., you may qualify for tax credits for out-of-pocket medical expenses, which can include surrogacy-related costs. Still, you may have to consult with a tax professional to explore this possibility.

Consult with Financial Advisors

Before you embark on the surrogacy journey, it’s wise to meet with a financial advisor. This is because they can help you prepare a financial plan, optimize savings, and navigate potential tax benefits.

Intended parents must know that while the cost of surrogacy is high, the joy of welcoming a new family member is priceless. Also, thorough financial planning will help make the surrogacy process less stressful, allowing you to focus on the exciting journey ahead.

Why budget planning is required in Surrogacy?

Surrogacy is a deeply personal, emotionally charged journey that brings immense joy and fulfilment to intended parents. However, this pathway to parenthood can also be a significant financial undertaking, making budget planning a critical aspect of the process. That said, you can understand the significance of budget planning in surrogacy with the help of the following points.

Understanding the Full Cost: Surrogacy involves a range of expenses, some of which might be less apparent at first glance. Moreover, even affordable surrogacy programs include components like surrogate compensation, agency fees, legal costs, medical expenses, travel costs, and potential unexpected expenses such as those associated with multiple pregnancies or complications. That said, understanding and itemizing these costs can help intended parents prepare for the full financial impact and avoid any surprises.

Managing Expectations: Budget planning can provide a reality check on what’s financially feasible. Moreover, the surrogacy process, including in-vitro fertilization (IVF), is expensive. That’s where early budget planning can help you assess whether surrogacy is a viable path for you, and if not, it can help you explore alternatives such as adoption.

Avoiding Financial Stress: Without proper budgeting, the existing cost of even a low-cost surrogacy program may add more stress to your surrogacy journey. Besides, a well-planned budget helps ensure that the financial aspect of surrogacy is manageable and under control.

Informed Decision Making: By knowing the approximate costs, intended parents can make informed decisions. For instance, they may decide to go with a surrogacy agency offering a more inclusive package or a comprehensive insurance policy. Besides, budget planning can also determine the choice of the egg or sperm donor and other crucial aspects of the surrogacy process.

Planning for Contingencies: Despite going for customized plans, unexpected costs may arise even in affordable surrogacy programs. Moreover, complications in pregnancy, additional medical procedures, or changes in laws can increase costs significantly. That said, a robust budget plan should include a contingency or emergency fund for these unforeseen expenses. If you are in the market for superclone , Super Clone Rolex is the place to go! The largest collection of fake Rolex watches online!

Facilitating saving and Investment: Once you have a clear picture of the required budget, you can determine how much you need to save or invest. Also, whether you decide to cut back on discretionary spending, seek financing, or invest in suitable financial instruments, a budget will serve as your guide.

Securing Your Future: Surrogacy isn’t the end of the financial journey. Besides, raising a child comes with its own set of costs. That said, a sound budget plan for surrogacy ensures that you don’t deplete all your resources, leaving you better prepared to manage future expenses.

Nurturing Your Relationship: Financial disagreements can strain relationships. That said, the high costs associated with surrogacy can heighten these tensions. Hence, clear, agreed-upon budget planning can reduce potential conflict between partners and help maintain harmony throughout the process.

Ensuring Ethical Practices: A transparent budget can help ensure ethical practices throughout the surrogacy process with an affordable surrogacy agency. Moreover, it enables you to account for all payments, confirming that they adhere to legal and ethical standards, which is crucial for the peace of mind of all parties involved.

FAQs related to financial planning for Surrogacy

Q. Do I need to plan for the surrogacy cost in advance?

-Although financial planning for surrogacy costs is optional, it could help you in managing the cost and related aspects during every step of your surrogacy journey.

Q. Are there any insurance options available for surrogacy?

-It depends on the region and country you are opting for surrogacy in. Still, the best way is to check with a qualified surrogacy professional in this regard.

Final words

Summing it up, we can say that the surrogacy journey is undoubtedly filled with emotional and financial ups and downs. However, thorough budget planning can significantly alleviate the financial stress and uncertainties, allowing intended parents to focus more on the exciting anticipation of their new arrival. That said, by being financially prepared, you can navigate the surrogacy journey with more ease and peace, ensuring it becomes a truly fulfilling experience.